Don’t stress! Make a wise tax investment choice this time

Multiple tax saving options, complicated sections and a fast approaching deadline!

These last 5 days are really taxing, as we look up for several tax saving investments to take a last minute decision. But is tax saving your sole objective?

Tax planning cannot be considered in isolation. In fact, it is a part of holistic financial planning hence it is important to make sound investment decisions, which not only helps you in saving taxes but also helps you create wealth for future.

How much do you need to save?

Before identifying one such investment option, let us understand the basics of Section 80 C. Under Section 80 C of Income Tax act, the government encourages you to save and invest up to Rs 1.5 lakhs every year through several options such as Public Provident Fund (PPF), National Saving Certificate (NSC), Tax-saver Fixed Deposits, Unit Linked Insurance Plans (ULIPs), Equity Linked Savings Scheme (ELSS) etc.

Why ELSS scores over options?

As an investor, you may have 3 basic expectations from your tax saving investments – maximum tax savings, liquidity and returns. ELSS scores over all the other tax saving options on all these parameters.

TAX BENEFIT

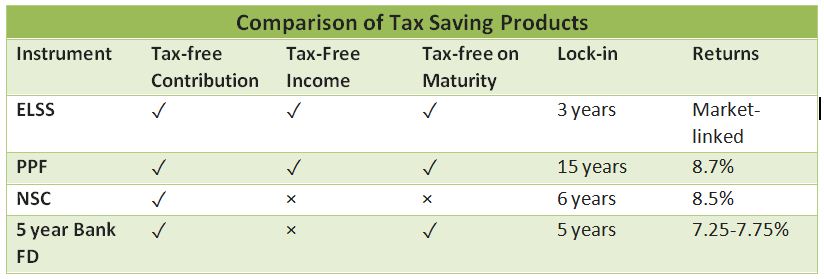

You can claim a tax deduction of up to Rs 1.5 lakh under Section 80C of the Income Tax Act.

If you invest Rs1.5 lakh,

· You get tax exemption on the investment amount.

· The final corpus at maturity is tax-free.

· If you opt for dividend option, dividends are tax-free.

· Since the lock in period is 3 years, no capital gains tax is applicable on sale of ELSS units.

Apart from PPF, only ELSS offers tax-freereturns. At the same time, the lock in period for an ELSS is much lower at 3 years as compared to that of PPF at 15 years.

Liquidity

The lock in period is only 3 years as compared to those of other tax saving investments, which fall in the range of 5-15 years.

If you start a Systematic Investment Plan (SIP) in an ELSS, theneach of your investments will be locked in for 3 years from the respective investment date.

Moreover, if you choose the dividend option, the AMC may announce a dividendget a part of the investment back during the lock-in period itself, by way of dividend payout.This enhances your liquidity and these dividends are tax-free.

Returns

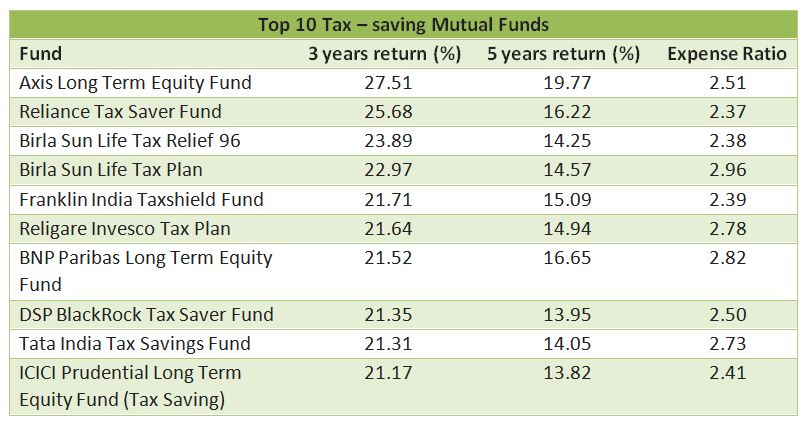

As with an equity fund, ELSS funds invest 65-100% of the corpus in equity and aim at making the most of the potential of the equity markets. According to Value Research data, ELSS has generated 19.2% returns in the past 3 years even as Nifty and Sensex have reported returns of 10.92% and 10.57% respectively, in the same period.

As mentioned earlier, you can get a part of the investment back during the lock-in period itself, by way of dividend payout, which are tax free in the hands of the investor.

Source: Value Researchonline.

Data as on 23rd March 2016.