Don’t Skip the SIP this time! Invest in shares SIP by SIP

Every time the stock market falls, market gurus suggest, it’s a good time to buy stocks. But the possibility of a further drop in the markets, makes us wait for the best time to enter the market. Then the Sensex and Nifty goes up and we just keep staring at the bus, we missed. Once again we wait for the stock market to touch another low.

Even this time, the story was no different. The stock market’s opening innings was weak in 2016 and the benchmark indices- Sensex and Nifty-crashed 6.90% and 7.05% respectively in February 2016. Most investors still waited on the sidelines anticipating the stock prices to fall further. Then came the anti-climax in the month of March. The benchmark indices recovered by over 10% since the beginning of March.

Does that mean you lost another good opportunity to invest in stocks? The ups and downs in markets keeps throwing plenty of investment opportunities at us. Hence the wisdom lies not in timing the markets but spending time in the market.

Historical evidence suggests that the stock market not just gives you best returns in the long term but also helps you beat inflation. However, if you are worried about the impact of volatility of equity on your investments, you could consider starting a Systematic Investment Plan (SIP) in stocks of our choice.

What is an SIP?

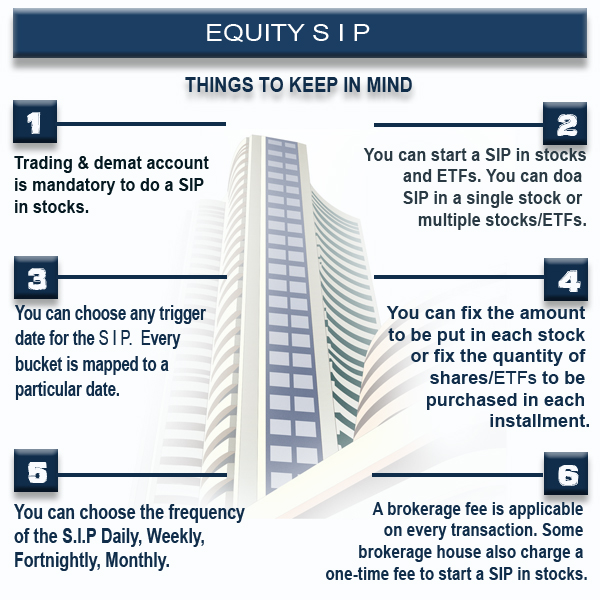

Today most brokerage houses such as ICICI Securities, HDFC securities, Kotak securities, Reliance Securities etc. give you an option to a SIP in stocks of your choice.

Just like mutual funds, an equity SIP allows you to invest fixed amounts in a single stock or basket of stocks/ exchange-traded at regular intervals. You can fix the number of shares/ETFs or the SIP amount and choose a weekly, fortnightly or a monthly SIP.

How to start an Equity SIP?

You need a trading account with a stock broker to start a SIP in stocks. Although, you have the option of giving cheques, it is much simpler to carry out an automated electronic clearance from your bank account, which is linked to your trading account. The shares are bought at the prevailing market rate at the time of SIP and the shares get credited to your demat account.

Why Equity SIP makes sense?

1) Volatility in Markets: If you are wary about burning your fingers in the market by invest all the money at one go, an equity SIP could come in handy. Any day a staggered approach in volatile markets can work to your advantage.

2) Eases financial burden: Although blue chip stocks may be available at lower valuations, bulk purchases can eat up all your surplus cash. Small-sized disciplined investments can help you add good quality stocks to your kitty, at frequent intervals.

3) Experience the power of compounding: SIPs will help you harness the power of compounding as you invest a fixed amount every day/week/month irrespective of the ups and downs in the market.

4) Reduces the average cost: If you fix the amount then you end up buying the same stock at high prices as well as low prices. In the financial lingo, this is called rupee-cost averaging, which reduces the overall average cost of purchase.