Should you invest in RBI Inflation Indexed National Savings Securities-Cumulative (IINSS-C)

RBI has launched Inflation Indexed National Saving Securities on 23rd December. Unlike inflation indexed bonds launched earlier this year which are linked to whole sale price index (WPI) these bonds are linked to consumer price index (CPI) which is better indication of the retail inflation. Face value of bond is Rs. 5000 and issued at par. Investor can buy minimum one bond and in multiples thereof but maximum100 bonds. That means investor can invest minimum Rs. 5000 and Maximum Rs. 5,00,000/- per annum in these bonds. These bonds will be available for sale only till 31st December this year.

Who can invest in these bonds

Resident individuals can invest in their own name or on behalf of their minor children. Non Resident Indians (NRIs) are not eligible to invest in these bonds. If you apply in joint name you also have option to hold the investment in either or survivor option. Other than individuals HUF and charitable institutions are also allowed to invest in these bonds.

Liquidity

Bonds will mature after 10 years from the date of issue but early redemption is allowed after three year of holding. Senior citizens who are 65 years and above can redeem their bonds prematurely after holding period of three years. Early redemption will be allowed only on coupon date subject to 50% of the last coupon payable. These bonds are not tradable in the secondary market. Interest is cumulative. Investor can avail loan from banks and other financial institutions against their investment in these bonds.

Safety

Since these bonds are issued by RBI on behalf of government of India hence carry highest safety. Your capital is protected but interest is not fixed other than 1.5% fixed rate and depends on inflation.

Returns

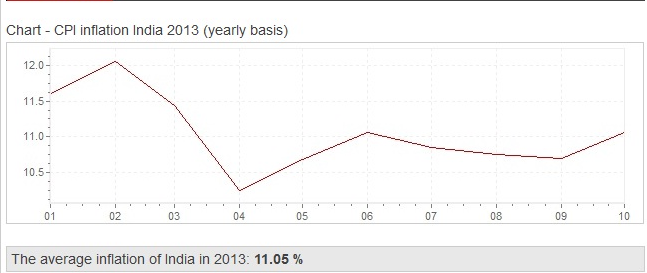

Interest rate is 1.5% per annum above inflation rate. In case of deflation minimum 1.5% is guaranteed. There cannot be negative returns in any case. For instance, if inflation is 8% investor will get 9.5% per annum but in case inflation is -2%, investor will still get 1.5% returns as that is guaranteed. Interest will be compounded half-yearly and will be payable on maturity along with the principal.

How to Invest

Investor can submit application in the prescribed format accompanied by the necessary payment in the form of cash/drafts/cheques/online through internet banking at authorized banks. The authorised banks are responsible to ensure compliance with the applicable KYC norms. In addition to all public sector banks like State Bank of India, Punjab National Bank, Bank of India, Central Bank etc. investors can also buy these bonds from any of the three private sector banks viz. ICICI Bank, HDFC Bank and Axis Bank. Bonds can also be purchased from Stock Holding Corporation of India Ltd (SHCIL).

Tax treatment

There is no TDS applicable however interest is taxable in the hand of investor at the slab rate applicable to individual. Since interest is accrued and payable only on maturity, hence investors can pay tax annually on accrual basis or at the time of maturity on cash basis as computed in accordance with the method of accounting u/s 145 of IT-act. There is no upfront tax benefit on investment.

Our Recommendation

Because these bonds offer you 1.5% higher interest than inflation hence it looks attractive considering present inflation rate in India but because interest is taxable hence post tax returns may not be able to beat inflation. For instance, if pre tax return is 9.5% per annum, post tax returns will be 8.52%, 7.54% and 6.56% per annum for individuals who are in 10%, 20% and 30% tax brackets respectively. On the other hand Public Issue of Tax Free Bonds Issued by National Housing Bank is also open till 31st January 2014. Interest rate on these bonds is up to 9.01% per annum. Individuals who are in 20% and 30% tax brackets for them it makes batter sense investing in tax free bonds. But investors who are exempted from tax or are in lower tax bracket can consider investing in IINSS-C.