Liquid Fund- An Ideal Option to Park Your Savings

Money available in your saving bank account comes handy in case of an emergency as it comes with round the clock ATM facility. Also, maintaining adequate balance in saving bank account is must to meet the regular expanses but a large amount of cash lying idle in your saving bank or current account loses the opportunity to earn good returns. Most of banks offer only 4% interest on the balance amount in your saving bank account which is much lesser than the inflation rate. Moreover, there is no interest payable on balance in current account. Obviously, it doesn’t mean that you invest the money reserved to meet your short term needs in equity or lock it in the long term investment options in expectation of higher returns but knowledge about liquid fund can help you earning little extra returns compared to bank interest. Liquid funds are ideal option to park the short term fund, as not only they offer a better yield but can also be liquidated easily. Liquid funds are a kind of debt oriented mutual fund schemes that invest in short term debt and money market instruments such as certificate of deposits, commercial paper, treasury bills, Borrowing & Lending Obligation and Other debt securities.

Liquidity

The key objective of liquid fund is to provide high liquidity to the portfolio and generate stable income. Liquid funds meet this objective as all redemptions payouts are normally credited to the bank account on the next working day if the redemption request is received within the cut-off time (i.e. upto 2 p.m.). Moreover, liquid funds generally have no exit loads. Investors have flexibility of investment options like growth and dividend with daily, weekly and monthly frequencies.

Expected Return

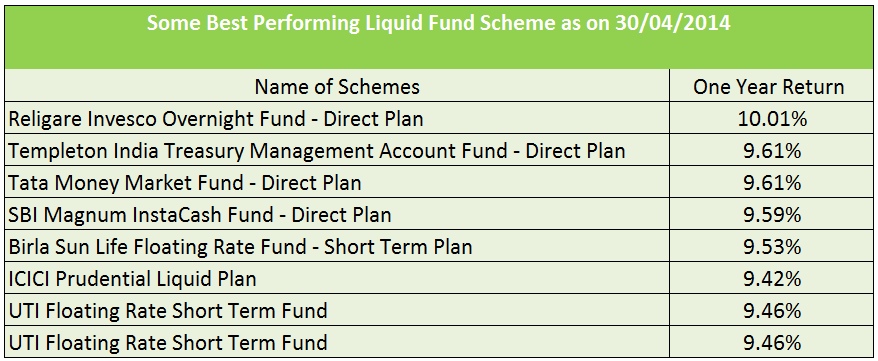

Like any other mutual fund scheme Liquid Fund schemes too don’t offer guaranteed return and depends upon performance of underlying asset in the scheme. Though past performance is no guarantee of future result yet as a reference point one should note that the average returns of liquid funds have been 9% in last one year while 8.94 and 7.45 in last 3 and 5 years respectively.

Risk on Investment

Yield of debt securities like bond, debenture or Treasury bill is inversely proportional to the change in interest rate. Sensitivity to the fluctuation of interest rate will be higher if the maturity of the debt instrument is longer. Good point to note here is that because such funds invest in the debt instruments having maximum residual maturity upto 91 days hence they are least affected by interest rate fluctuations. Further, the probability of the credit risk i.e. the risk of default is also low due to short maturity of investment portfolio.

Applicable tax on liquid fund

Depending on the holding period investment in liquid fund is determined as short term or long term capital assets. Holding period less than one year is considered as short term and holding period more than one year is long term. If units are redeemed within one year from the date of purchase then the Short-term capital gain is added to other income of the investor and taxed at the applicable rate. The rate can be 10.3%, 20.6% or 30.9% depending on the individual’s income. For non individual like company and partnership firm income tax is flat 30.9%. In case of long term capital gain the amount is taxed at 10.3% flat or 20.6% with benefit of indexation whichever is less.

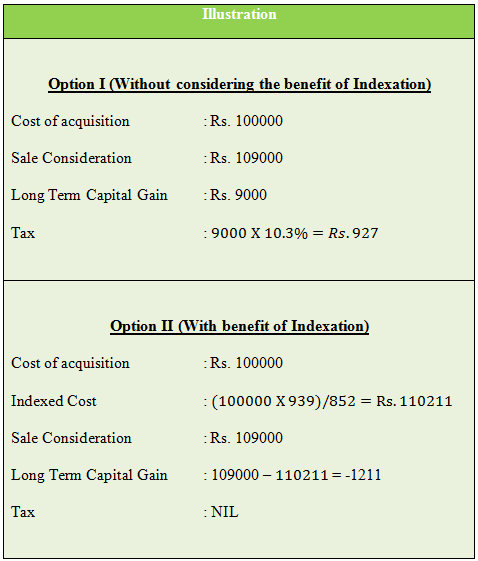

We can better understand this by a calculation. For instance Ravi invested Rs. 1 lakh on 10th April, 2013 and redeemed all units in his portfolio on 10th April 2014, right after one year when the value of his investment was Rs. 109000. Cost Inflation Index for FY 2012-13 is 852 and for FY 2013-14 it is 939.

He actually had profit of Rs. 9000 on which he could pay tax of Rs. 927 at 10.3% (Option I). But after considering the benefit of cost inflation index he had capital loss of Rs. 1211 (Option II). Therefore, Instead of paying any tax on the profit he can set off the loss against other long term capital gain. Dividend is tax free in the hand of investor but fund pays dividend distribution tax at 28.33 % and it is adjusted in NAV.

Investors who are ready to hold their investment in liquid fund for more than one year can opt for growth option but investors who invest for short term can choose the option based on their income. In short term opting for dividend option can be beneficial for investors who are supposed to pay 30.9% on their income for all others it can be growth option.