How to Sidestep from Becoming a Bank Loan Defaulter?

Expenditures are inevitable and unexpected. It is really difficult to stay away from expenses as they are bound to bother you in any particular form. Many a times expenditures exceed the earnings and this is where matters get worse for an individual. The need to fill in the gap created between the two heads becomes significant. However, things get much more serious when one is not able to repay their bank loan within the stipulated time period. This is exactly what happened with Arvind who miscalculated his earnings and expenses. He ended up becoming a bank loan defaulter and had to go through a lot during the course of time.

Anyone who feels that he is heading towards becoming a loan defaulter needs to take some serious steps to change his path. Analysing the problems and resolving them immediately can help you in sidestepping from becoming a bank loan defaulter.

How do People become Bank Loan Defaulters?

These days, most of the people find bank loans to be the most effective solution for making different ends meet. People acquire loans for going on vacations or buying their favourite gadgets. The easy loan policies followed by the banking institutions allow you to get loans in really quick time. However, what most of the people don’t do is to keep a track of their expenses and earnings. As a result, they end up being bank loan defaulters as they fail to repay their loan along with the interest.

The Importance of Taking Corrective Measures

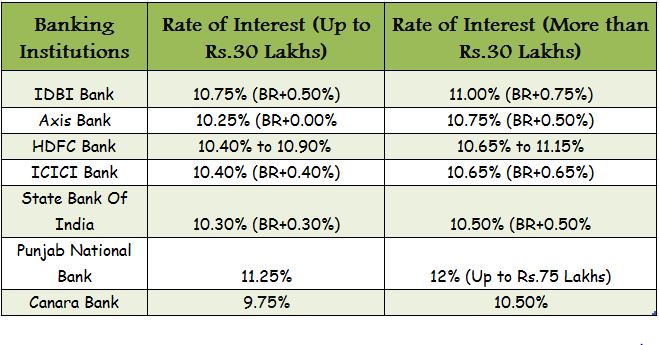

An individual needs to keep a check on whether he is actually paying the loan instalments on time or not. As soon as you find out that you have made a mistake, you need to rectify it right away. Try and reduce the monthly expenditures so that you can easily accommodate the loan repayments within your budget. Avoid taking any second loan when you haven’t repaid the first one. Keep an eye on the home loan rates if you are going for a home loan.

Current Home Loan Interest Rates (Floating) of Some Banks

Principles of Loan

It is important to keep a track of the present and future situations while taking a loan. Any situation can change drastically and so one should go for a bank loan only if their present capacity allows. The future can be absolutely uncertain and unpredictable, so don’t forget to save some money for making the loan instalments. Develop certain principles for repaying the loan so that you don’t have to regret any of your decisions.

Saving is the Key

Saving money can offer you innumerable advantages when it comes to repaying a loan. Loan repayment is a long term process and so one must save some money for the future. You should never allow the rate of savings to get affected by the loan instalments. Budget all your expenses so that you can save better.

Keep Talking to the Lender

Stay continuously in touch with the lender as they make the final decision regarding the terms of a bank loan. It completely depends upon the lender whether the term will be in your favour or not. So, you should try and be consistent in your debt payments.

Keep Advance EMI Ready

Keeping your next EMI ready in advance is another important thing that you must do in order to sidestep from becoming a loan defaulter. Keep some money aside so that you can use it in the future if your expenses exceed the earnings.

Circumvent Situations Leading to Bank declare the loan an NPA

Defaults on repayment of loan for few months at a stretch can lead to bank declaring the loan a Non Performing Asset. Following which the bank can start the recovery process by liquidating the underlying asset So you need to take effective steps to circumvent all the situations that lead to it. Whenever you feel that you might end up missing more than two EMIs, you need to start taking steps to avoid the situation. Cut down your expenses and enhance your overall cash flow. Refinancing is another smart step that you can take for avoiding such situation.

Reduce the Loan Amount and Extend the Tenure

The relationship between the lender and the borrower needs to be really strong. They need to have a sound understanding so that the terms of a loan can be extended at will. With a strong understanding, an individual can reschedule their loan and avoid being a loan defaulter. Extending the tenure really offers a strong cushion to the borrower.

Switch Loan with Some Other Bank

Switching your loan with some other bank can prove to be a great idea in the worst case scenario. Try and get eased loan terms from some other bank if you are facing issues with your present bank. Failing to repay the loan amount on time can get you into a lot of trouble! So, why take chances? Secure your future by taking smart decisions regarding your loan repayment.