Home Loan Checklist – Your Worksheet for Obtaining the Right Home Loan

Buying an ideal home is no longer considered a far-fetched dream. With the ubiquitous availability of excellent financing options in the form of home mortgages, the dream of owning a perfect house is well within the reach of the small and medium income families. However, in these uncertain times, with almost every major player in the banking industry tightening their lending criteria, more people are facing rejections for mainstream credit. Households, especially lower-income ones, have already been suffering a lot due to the hard-hitting recession. As a result, an increasing number of needy families are turning towards easily available loan schemes from NBFCs or the autonomous moneylenders having debilitating rates of interests.

Going for home loans might be a challenging, frustrating, and, at times, an intimidating affair, but this doesn’t necessarily mean shifting out to subprime lending options. No doubt there are impressive and alluring offers overflowing in the non-prime and other unregulated markets, but they are no less daunting than the conventional loans. In fact, they involve an additional element of risk over a period of time, which certainly makes them a bad choice of financing. However complicated might be the process of obtaining conventional loans, there are some things that one might keep in mind to make the process hassle free and reduce the chances of rejection. These points not only help in making the home loan process flow smoothly, but also lend a helping hand in finding the right credit.

Thorough Market Research

Seeing the day-by-day reduction in the number of loan customers, banks have come up with attractive loan plans for the borrowers with reduced interest charges and several other additional benefits. Amid an ocean full of choices, it becomes imperative to be educated about the specific terms and conditions of every loan option and be prepared beforehand. All the associated doubts, even the smallest ones, should be clarified before the things are finalised in order to avoid any difficulties from arising in the future.

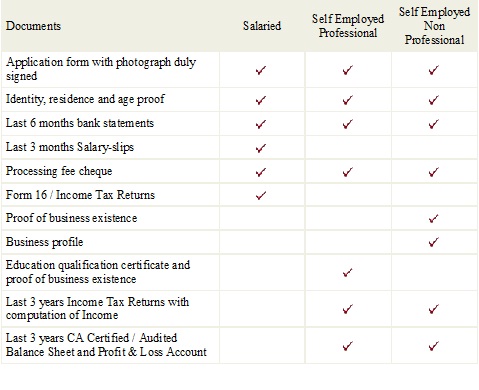

Documents Required

Calculate EMI

The EMI needs to be given utmost importance when choosing a home loan plan. One should calculate the amount of monthly installment that is well within the budget before finalising anything. There is no other person that knows about the money better than oneself. So, while keeping in mind the present monthly income, one should calculate an approximate amount of installment that can be easily paid every month. Any hasty decisions here might result in troublesome penalties if one is not able to pay EMI on time.

Interest Rate Negotiation

Even when the banks and other financial institutions that provide loan stick to the fact that the interest rates cannot be negotiated, there is still little scope for adjustments based on profile of borrower. Negotiations can only be done when the borrowers have selected the property and want to complete the transactions involved at the earliest. The situation can be in favour of the borrowers if the process of loan disbursement is carried on at the end of a month. Every sales person in the loan department has a monthly target. By the end of the month, to complete their target, sales people offer certain additional benefits and schemes.

Eligibility Factors

Noncompliance to the eligibility criteria is the prime reason behind the increased number of rejections of loan applications. Apart from complying with the stated eligibility factors, the borrowers need to carry all the necessary documents. A better credit score can help the borrowers in stepping higher on the eligibility list for obtaining a home loan. Sometimes, the lenders, with the wrong intentions, publish some hidden factors in small font at the end of the loan documents. No matter how bulky the loan agreement is, one should never imprint a signature on it unless every major and minute detail is read and understood carefully.

Extra or Hidden Charges

Having a clear understanding about the interest rates and every extra bit of charges that are often added to the home loan schemes always proves beneficial when applying for mortgage loans. These charges might include service charges, processing fees and other similar costs. These additional costs often fall under the total amount of the loan sanctioned, not under the loan amount that the borrowers walk out of the bank with. So, before making a final decision, it is imperative to take note of these charges that are often included in the loan schemes.

Applying and procuring finance for buying a new home appears to be fairly easy, but it has its own set of complications. Keeping the aforementioned points in mind is definitely a good way to begin the process of finding an ideal loan. They will not only make things easier in the long run, but will also help in reducing the chances of a loan application being rejected. So, have everything ready beforehand to open the doorway to a dream home in a hassle free manner.