All Equity Schemes Are Not Alike

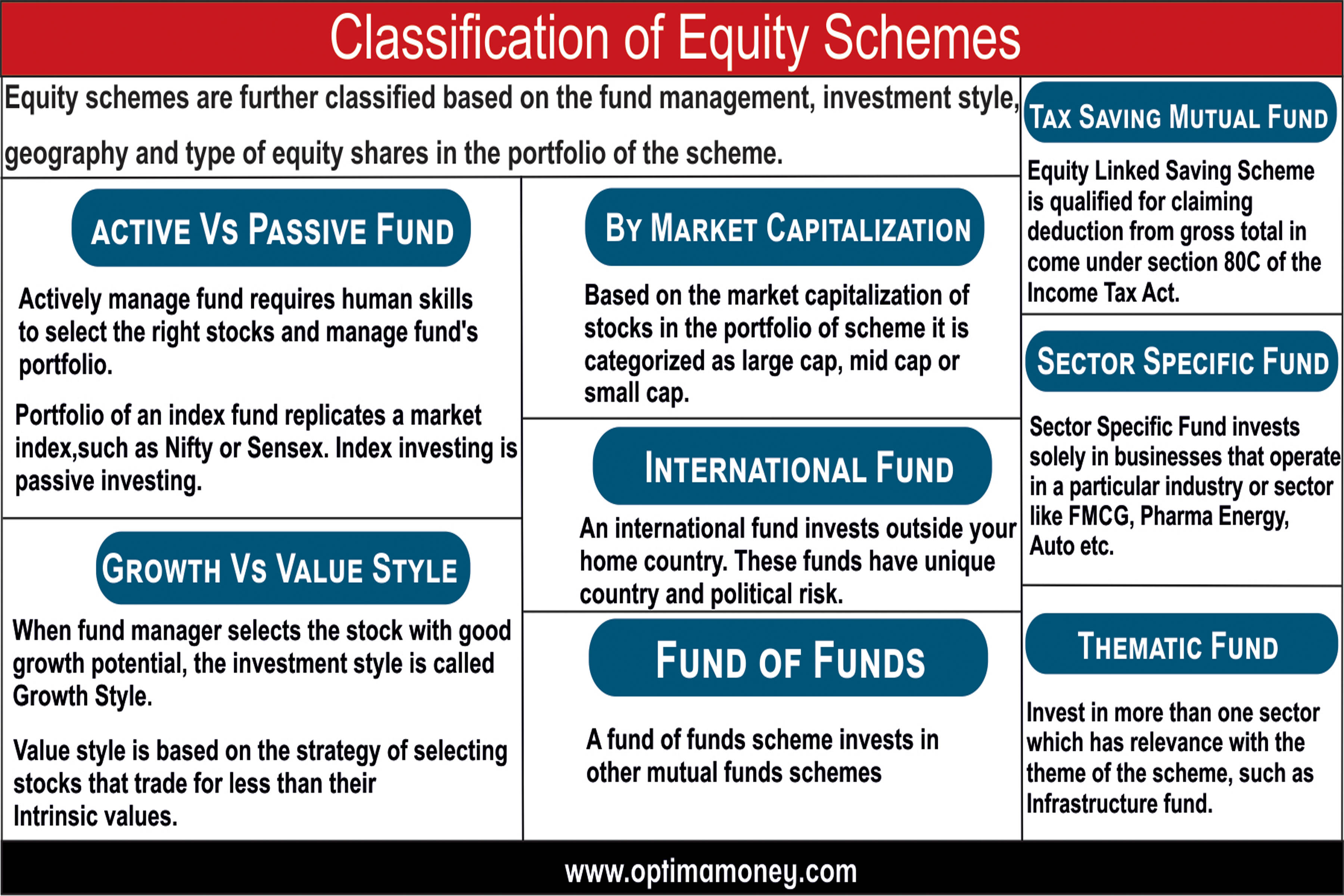

Equity has always outperformed other asset classes in long term but selection of right equity share and managing portfolio is not an easy task. It needs lot of research and professional approach. Therefore, many investors prefer to invest through mutual fund over direct investment in equity shares. Any mutual fund scheme that invests in equity share is classified as Equity Mutual Fund but all schemes are not alike. Equity schemes are further classified based on the fund management, investment style, geography and type of equity share in the portfolio of the scheme.

Active Vs Passive Fund

Actively manage fund requires human skills to select the right stocks and manage fund’s portfolio. Fund managers use an investment approach that typically involves research such as fundamental and technical analysis. Objective of active management is to outperform the broader market with right selection of securities. The opposite of active management is called passive management, better known as “indexing”. Portfolio of an index fund is constructed to match or track the components of a market index, such as Nifty or Sensex. An index mutual fund provides broad market exposure, low operating expenses and low portfolio turnover. This type of mutual fund replicates the performance of index to which they track.

Growth Vs Value Style

Fund managers follow two different investment styles, growth and value. When fund manager selects the stock with good growth potential, the investment style is called growth style. In most cases a growth stock is defined as a company whose earnings are expected to grow at an above-average rate compared to its industry or the overall market. Value style is based on the strategy of selecting stocks that trade for less than their intrinsic values. Fund managers who follow value style actively seek stocks of companies that are available at discount of its real value. They believe the market overreacts to good and bad news, resulting in stock price movements that do not correspond with the company’s long-term fundamentals. These kinds of mutual funds give higher return in long term when the real value of underlying stocks is discovered.

By Market Capitalization

Market Capitalization is calculated by multiplying the number of company’s outstanding shares by its current share price. Based on this, a stock is categorized as large cap, mid cap or small cap. A mutual fund scheme that has large cap stocks in its portfolio is called large cap fund and a scheme with small and mid cap stocks in its portfolio is called small and mid cap fund. A fund investing in very small companies is called micro cap Fund. There are diversified mutual funds which can invest in stocks across market capitalization.

International Fund

An international fund or foreign fund invests outside your home country. These funds have unique country and political risk. Investors who are looking for further diversification of their equity portfolio and want to get benefit from growth of companies listed outside India can consider investing a limited portion of their portfolio in such schemes.

Fund of Funds

A mutual fund scheme that invests in other mutual funds is called Fund of Funds scheme. International fund and gold saving funds in India are fund of funds schemes. Some equity FOF schemes invest in more than one mutual fund. These funds are also called multi-managers funds. A fund of funds offers a broad diversification and an appropriate asset allocation to investor with investments in a variety of fund categories that are all wrapped up into one fund.

Tax Saving Mutual Fund (ELSS)

Equity Linked Saving Scheme (ELSS) is a type of diversified equity mutual fund which is qualified for claiming deduction from gross total income under section 80C of the Income Tax Act. ELSS offers the twin-advantage of capital appreciation and tax benefits. It comes with a lock-in period of three years.

Sector Specific Fund

Such fund invests solely in businesses that operate in a particular industry or sector like FMCG, Pharma, Energy, Auto etc. Sector specific fund have potential to deliver higher return when there is an increased demand for the products or services offered by the company in which the funds invest. On the other hand, if there is a downturn in the specific sector in which the fund invests, investor may face heavy losses due to the lack of diversification in the holdings of the scheme.

Thematic Fund

Thematic funds can be considered something between diversified equity fund and sector specific fund. Thematic fund don’t invest across the sectors. So they are not fully diversified but unlike sector specific fund they do invest in more than one sector which has relevance with the theme of the scheme. For instance, an infrastructure fund invests in sector like construction, energy, telecommunication etc. A transportation and Logistic Fund has stocks from automobile, engineering and services in its portfolio. Objective of thematic fund is to deliver optimal returns by investing in stocks which qualify to belong within the particular theme.